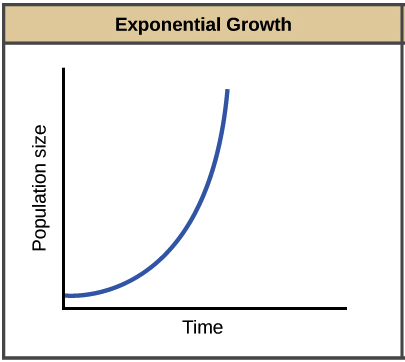

One of the principles of economics is the relationship between supply and demand. In the real estate industry on a macro scale, the land is the supply and the population is the demand. If we were to view this on a chart, the supply would be staying the same, while the demand is rapidly increasing. Using this logic, isn’t real estate a fail-proof investment in the long term?

Middle School was the first time I wondered how our country’s real estate will be able to support an exponentially growing population. During the 2010 census there was a live US population tracker website that we would watch in Social Studies class to see how much the population grew in an hour. I looked into how much our population was growing in our modern era and how it was unprecedented in human existence.

Around this time, we were also being exposed to the ideas of climate change and glacial melting. I couldn’t help but wonder, “If our population is exponentially growing and our land supply is finite, possibly even decreasing, doesn’t that mean that the value of land will continue to rise?” This is a difficult theory to consider and prove because it is so intangible. It isn’t something that you can see as you go about your daily routine.

One solution to this problem that we have seen over the past two centuries is building vertically to create more livable space. Although this does create more space it is not sustainable for all areas of the world. This is because land needs to be used for more than only living spaces. As demand for housing increases, the demand for resources does as well. Under these assumptions resources will be an even larger challenge than living spaces because it takes more land to support a society’s resource needs. Bill Gates is the largest farmland owner in the United States with over 300,000 acres because he understands the growing need for this space.

We need agricultural spaces, retail spaces and public spaces. There have been recent innovations such as indoor vertical farming and gardening which help combat this problem but we are nowhere near a long-term solution. Moving forward, we may see a strong rise in mixed use spaces. For example, a building that has retail on the first floor with a combination of agricultural spaces and apartments above that.

With rainfall and green spaces unevenly distributed throughout the world, the population will continue to flow into the most practical spaces. What does this mean for the future? Cities will continue to expand and move past their previous outskirts; suburban communities will continue to grow alongside these cities and the price of real estate will continue to rise. Unless something drastic changes, the demand for real estate will continue to rise. There will be a strong dependence on public policy to grow at a sustainable level. We will see a move towards smaller living spaces and the price of real estate will exponentially grow as the population does.

Written by Stephen Pearse